Alternative Network (AltNet) Broadband Providers

Alternative Networks (known as ‘altnets’) are challenger broadband network operators who are building new fast (usually fibre optic) networks to compete with incumbents like BT and Virgin Media. They are a key driver for growth of full fibre and provide great alternative services, if you can get access to one.

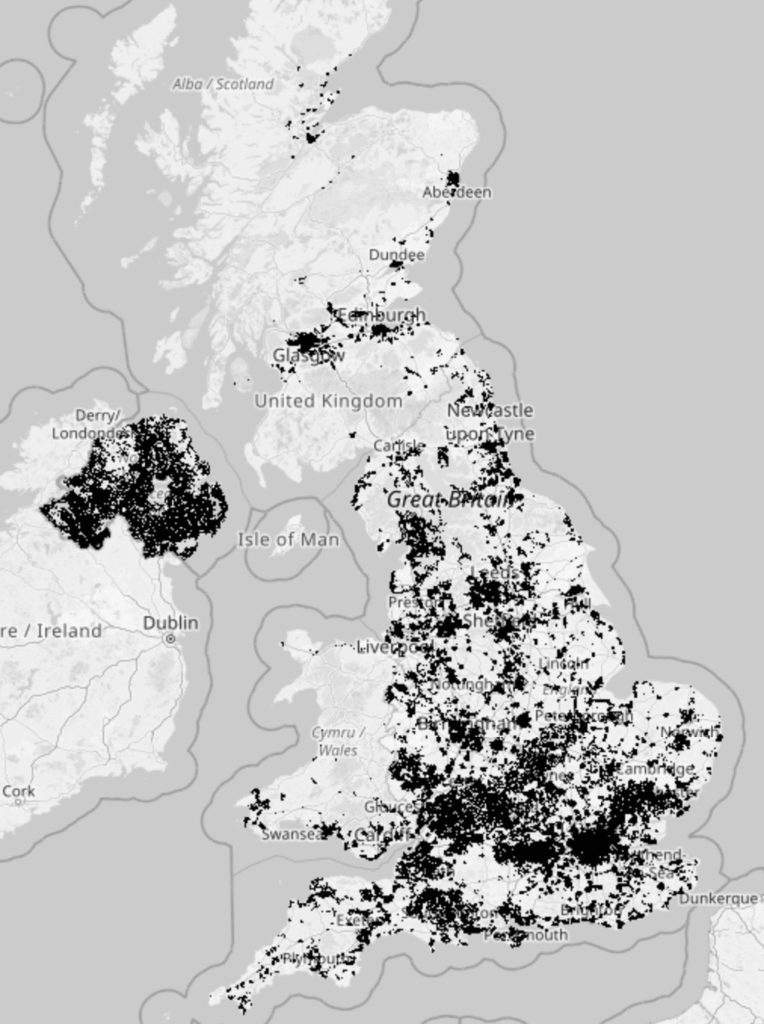

We have an interactive map of UK Broadband Alt-nets.

Why should you use an AltNet?

Alternative networks often deliver faster symmetric services (i.e. your download and upload speed are the same), with competitive pricing. Many also won’t increase your cost during your contract period like many of the larger operators. You will need to check with the specific provider you’re considering.

Find an altnet broadband service.

History

Back when broadband first started to be rolled out in 2000 we had two options, BT’s ADSL-based service delivered over copper telephone lines, or services from cable companies like NTL, Telewest and others. Although you could buy your service from a retailer who wasn’t BT (e.g. Nildram, Eclipse, etc.) they all linked back through BT’s network. After a brief spell of Local Loop Unbundling (LLU) where providers rented part of the telephone line from BT but ran their own service at telephone exchanges, we saw the birth of Openreach, a separate BT division which started providing access to BT’s physical infrastructure like ducts and poles to alternative networks.

Some altnets will install their own ducts and poles, whilst others will use BT Openreach infrastructure, known as “physical infrastructure access” (PIA) where they install their own cables in Openreach’s ducts or poles and pay a small rental fee. This avoids unnecessary roadworks in many cases. Unfortunately not everyone is served by a a clear duct with capacity or a nearby pole (for example some have direct bury copper cable) so in some cases new infrastructure needs to be laid.

Who are the major alternative network providers?

There are three main types of altnets, larger national ones (e.g. CityFibre, Hyperoptic, Community Fibre, etc.), those focussing on regions or more specific areas (Zzoomm, Brsk/YouFibre, Jurassic, G.Network), and smaller altnets (e.g. B4RN), some of which run for the benefit of the community they serve rather than commercial investors. You can view individual providers’ footprints on our broadband maps site as well.

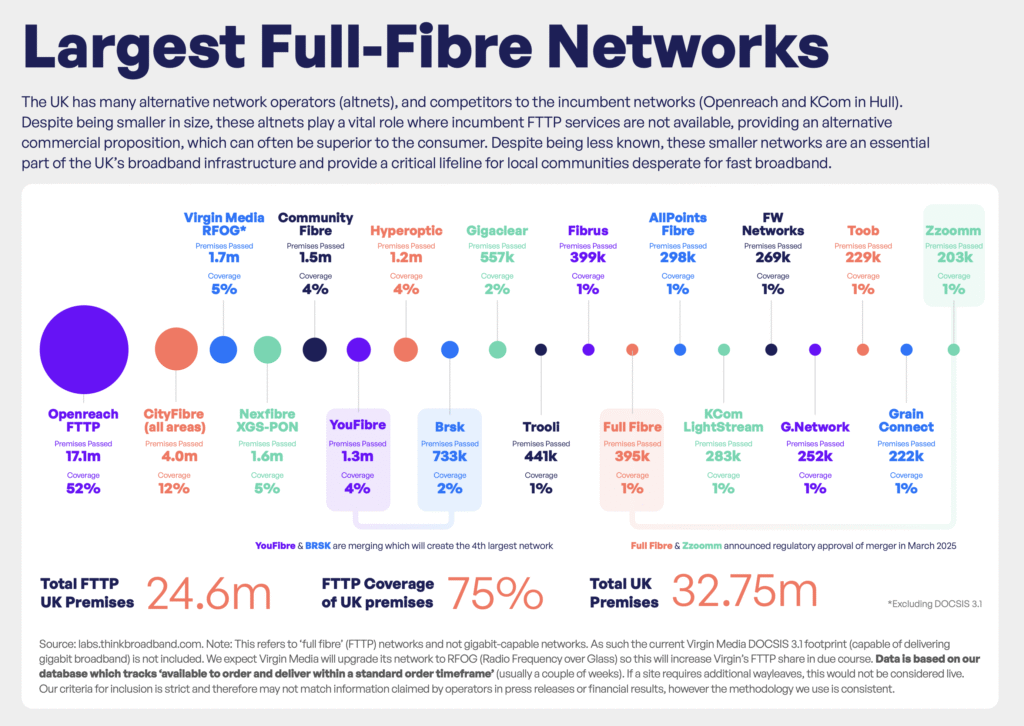

Our Broadband Report also tracks the build of the major altnets. We produce a graph of the full-fibre networks (including incumbents).

Technology

Most altnets use a combination of GPON, XGS-PON and point-to-point fibre services; fibre optic cables can carry much higher data rates as the same fibres used 25 years ago for 1Gbps in backhaul is these days used for 400Gbps or more, so this infrastructure is more future-proof than other technologies. Other wireless technologies are sometimes used, especially in rural areas, and can also be a precursor to full fibre rollout ensuring a sustainable customer base is present. Sometimes, micro-trenching, a technique of cutting a narrow path through a road can be used to avoid longer road closure.

You can track UK telecommunications operator roadworks on our broadband maps site (currently limited to England).

Business Models

Financing Approaches

There are various options for altnets when it comes to raising money. Obviously altnets provide Internet services in return for a monthly fee, however building physical infrastructure is very capex-heavy so building a business case may require various types of finance:

Private Equity — Most of the larger altnets are PE-backed by institutional investors/funds which expect a commercial return with a combination of debt and equity.

Community Share Issue — Some community-led initiative (by far the most successful example is B4RN) raise funding from individuals and businesses in the local community on the basis of a ‘limited return’. These parties want to bring fast broadband to the area, and will be paid interest for their investment. Typically this also includes limitations on maximum individual investment to ensure the business continues to operate for the benefit of the wider community, rather than individual inyerests

Project Gigabit — The government has provided various types of support including broadband vouchers, to help with the installation costs for extending gigabit-capable broadband across the entire UK. These vouchers help in areas where there are currently no commercial plans to deliver services.

Local Government — Local governments may in some cases be able to assist with targeted assistance to get coverage up in their local area.

Debt Finance — Some businesses will have bank loads or issue bonds if they have a strong enough balance sheet and business case.

Operational Models

Some alternative network providers build and operate their own services and do not re-sell access to their infrastructure for other service providers whilst others (e.g. CityFibre) focus on being wholesale-only and only supply their services through partners. Finally many altnets adopt a hybrid model which provide both direct services, as well as some through partners. Sometimes resale agreements may be limited to some areas, or only say consumer services.

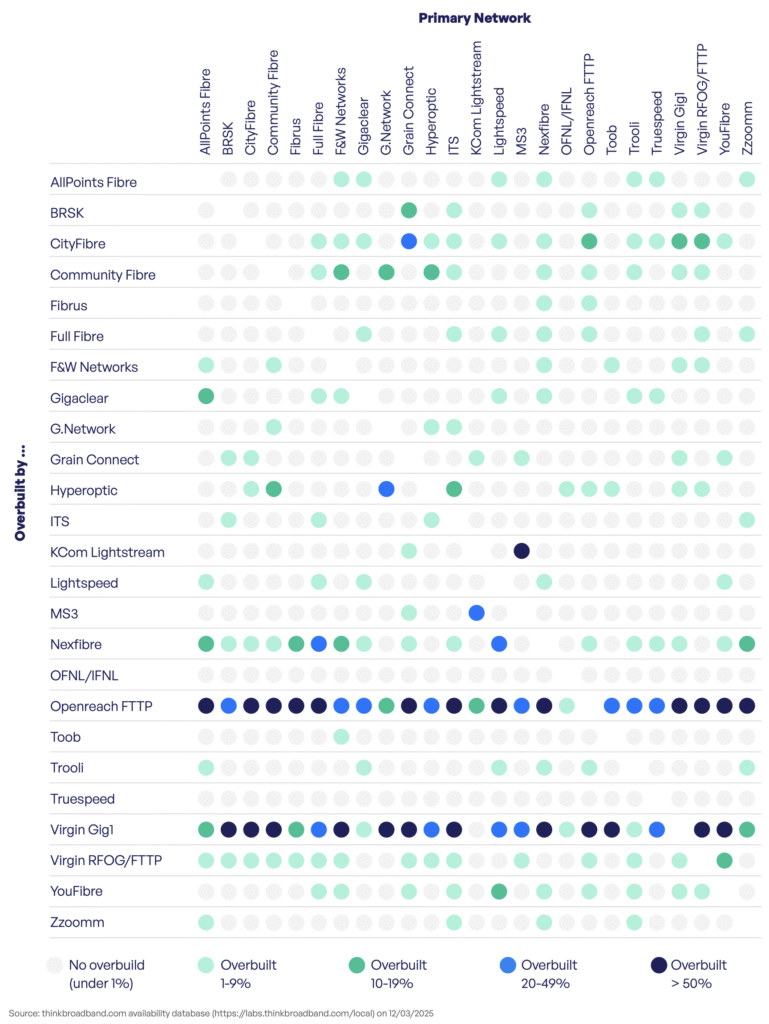

Overbuild

When a network operator builds in an area already covered by another network, this is known as ‘overbuild’. An operator may choose to do this if they want to compete, and competition/ diversity can be good for consumers and businesses alike, however it makes it a more challenging investment for investors in altnets who need to see a return on the capital they inject. It can therefore also be inefficient, and frustrating for those without access to even a single full fibre network.

As of March 2025, 75% of UK premises have access to one or more full-fibre networks. Approximately a third of these, or 24% of households have two full fibre networks, representing over-build. The overbuild rate in Northern Ireland is considerably higher; with a full fibre available to 96% of households, 38% of households have the choice of two or more network operators.

Our broadband report also includes an analysis of overbuild by alternative network operator:

Test your broadband speed

Test your broadband speed Follow us on X for the latest broadband news

Follow us on X for the latest broadband news